Multiple Choice

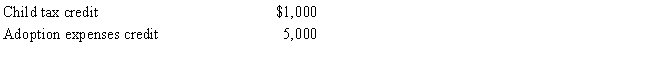

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000. and his tentative minimum tax is $195,000. Justin reports the following credits.  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A) $190,000

B) $194,000

C) $195,000

D) $200,000

Correct Answer:

Verified

Correct Answer:

Verified

Q55: The phaseout of the AMT exemption amount

Q68: In 2017, Brenda has calculated her regular

Q69: In 2017, Blake incurs $270,000 of mining

Q70: Use the following selected data to calculate

Q74: Under what circumstances are C corporations exempt

Q75: All of a C corporation's AMT is

Q76: Keosha acquires used 10-year personal property to

Q77: Beige, Inc., records AMTI of $200,000. Calculate

Q78: Which of the following statements is incorrect?<br>A)

Q94: In the current tax year, Ben exercised