Multiple Choice

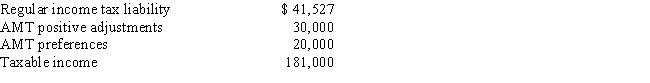

Robin, who is a head of household and age 42, provides you with the following information from his financial records for 2017. Robert itemizes deductions.  Calculate Robin's AMT for 2017.

Calculate Robin's AMT for 2017.

A) $6,633.

B) $13,332.

C) $48,828.

D) $54,428.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: The net capital gain included in an

Q11: Which of the following statements describing the

Q13: Are the AMT rates for the individual

Q14: AMT adjustments can be positive or negative,

Q15: Sand Corporation, a calendar year C corporation,

Q17: If the AMT base is greater than

Q19: How can interest on a private activity

Q21: Cindy, who is single and age 48,

Q38: How can an AMT adjustment be avoided

Q75: Wallace owns a construction company that builds