Multiple Choice

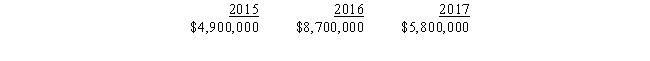

Mauve, Inc., records the following gross receipts in 2015, 2016, and 2017.  What is Mauve, Inc.'s TMT in each of these three years?

What is Mauve, Inc.'s TMT in each of these three years?

2015 2016 2017

A) $0 $0 $0

B) $0 $0 $1,160,000

C) $0 $1,740,000 $1,160,000

D) $980,000 $1,740,000 $1,160,000

E) $0 $1,740,000 $0

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Kerri, who has AGI of $120,000, itemized

Q32: What tax rates apply in calculating the

Q54: If a taxpayer deducts the standard deduction

Q79: Business tax credits reduce the AMT and

Q103: In 2017, Glenn recorded a $108,000 loss

Q104: Which of the following can produce an

Q105: For regular income tax purposes, Yolanda, who

Q106: In deciding to enact the alternative minimum

Q108: In 2017, Linda incurs circulation expenses of

Q109: After personal property is fully depreciated for