Essay

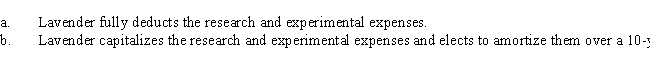

Lavender, Inc., incurs research and experimental expenditures of $210,000 in 2017. Determine the amount of the AMT adjustment for 2017 and for 2018 if for regular income tax purposes, assuming in independent cases that:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Why is there no AMT adjustment for

Q51: What is the relationship between the regular

Q76: Keosha acquires used 10-year personal property to

Q77: Beige, Inc., records AMTI of $200,000. Calculate

Q78: Which of the following statements is incorrect?<br>A)

Q79: In 2017, Brenda has calculated her regular

Q80: Which of the following regular taxable income

Q82: Since most tax preferences are merely timing

Q83: Assuming no phaseout, the AMT exemption amount

Q84: Darin, who is age 30, records itemized