Essay

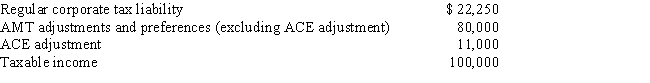

Crimson, Inc., provides you with the following information.

Calculate Crimson's AMT for 2017.

Calculate Crimson's AMT for 2017.

Correct Answer:

Verified

Crimson's ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Crimson's ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q16: Why is there no AMT adjustment for

Q48: When qualified residence interest exceeds qualified housing

Q51: What is the relationship between the regular

Q87: The AMT exemption for a corporation with

Q88: C corporations are not required to make

Q89: Beulah, who is single, provides you with

Q91: Mitch, who is single and age 46

Q92: Which of the following itemized deductions are

Q93: Identify an AMT adjustment that applies for

Q94: Bianca and David report the following for