Multiple Choice

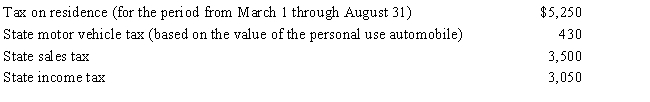

Nancy paid the following taxes during the year:  Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller. What amount qualifies as a deduction from AGI for Nancy?

Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller. What amount qualifies as a deduction from AGI for Nancy?

A) $9,180

B) $9,130

C) $7,382

D) $5,382

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Jim's employer pays half of the premiums

Q28: Linda is planning to buy Vicki's home.They

Q37: During the year, Eve (a resident of

Q42: Maria traveled to Rochester, Minnesota, with her

Q55: In 2017, Boris pays a $3,800 premium

Q56: Trent sells his personal residence to Chester

Q59: Tom, age 48, is advised by his

Q60: Ross, who is single, purchased a personal

Q61: Employee business expenses for travel qualify as

Q62: Ronaldo contributed stock worth $12,000 to the