Multiple Choice

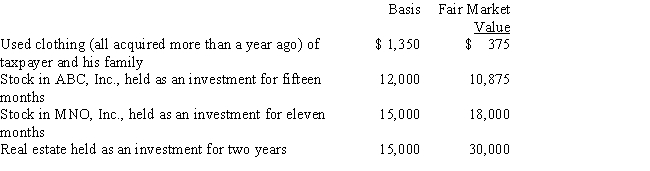

Zeke made the following donations to qualified charitable organizations during the year:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Phillip, age 66, developed hip problems and

Q6: A phaseout of certain itemized deductions applies

Q7: Rick and Carol Ryan, married taxpayers, took

Q8: Gambling losses may be deducted to the

Q10: In the current year, Jerry pays $8,000

Q11: Brad, who would otherwise qualify as Faye's

Q49: For the past several years, Jeanne and

Q62: Edna had an accident while competing in

Q79: Al contributed a painting to the Metropolitan

Q91: Shirley sold her personal residence to Mike