Multiple Choice

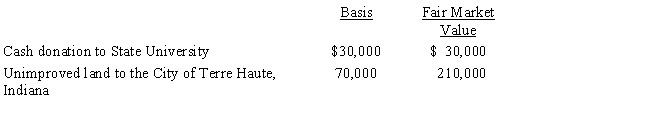

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:  The land had been held as an investment and was acquired 4 years ago. Shortly after receipt, the City of Terre Haute sold the land for $210,000. Karen's AGI is $450,000. The allowable charitable contribution deduction this year is:

The land had been held as an investment and was acquired 4 years ago. Shortly after receipt, the City of Terre Haute sold the land for $210,000. Karen's AGI is $450,000. The allowable charitable contribution deduction this year is:

A) $100,000.

B) $165,000.

C) $225,000.

D) $240,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Shirley pays FICA (employer's share) on the

Q47: Samuel, a 36-year-old individual who has been

Q57: Chad pays the medical expenses of his

Q63: During the year, Victor spent $300 on

Q73: Brad, who uses the cash method of

Q75: Brian, a self-employed individual, pays state income

Q77: In Piatt County, the real property tax

Q78: George is single and age 56, has

Q79: Adrienne sustained serious facial injuries in a

Q98: Fees for automobile inspections, automobile titles and