Essay

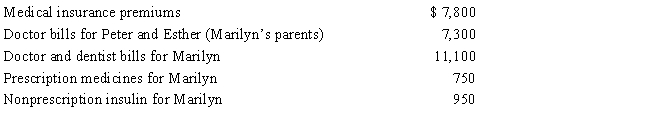

Marilyn, age 38, is employed as an architect. For calendar year 2017, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2017 and received the reimbursement in January 2018. What is Marilyn's maximum allowable medical expense deduction for 2017?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2017 and received the reimbursement in January 2018. What is Marilyn's maximum allowable medical expense deduction for 2017?

Correct Answer:

Verified

Marilyn's medical expense deduction is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A physician recommends a private school for

Q42: Maria traveled to Rochester, Minnesota, with her

Q44: In 2017, Dena traveled 600 miles for

Q45: Interest paid or accrued during the tax

Q46: Barry and Larry, who are brothers, are

Q48: Jack sold a personal residence to Steven

Q50: Quinn, who is single and lives alone,

Q51: Matt, a calendar year taxpayer, pays $11,000

Q62: Ronaldo contributed stock worth $12,000 to the

Q89: Excess charitable contributions that come under the