Essay

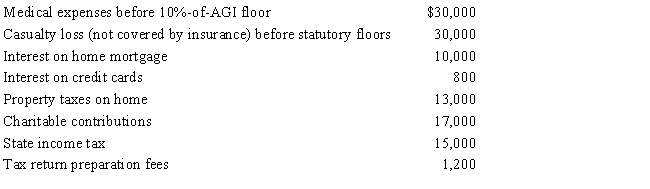

For calendar year 2017, Jon and Betty Hansen (ages 59 and 60) file a joint return reflecting AGI of $280,000. They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

Correct Answer:

Verified

For the medical expenses, the taxpayers...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Linda is planning to buy Vicki's home.They

Q37: During the year, Eve (a resident of

Q39: Bill paid $2,500 of medical expenses for

Q59: Tom, age 48, is advised by his

Q60: Ross, who is single, purchased a personal

Q61: Employee business expenses for travel qualify as

Q65: In 2018, Rhonda received an insurance reimbursement

Q68: Joe, a cash basis taxpayer, took out

Q75: A taxpayer pays points to obtain financing

Q88: For purposes of computing the deduction for