Essay

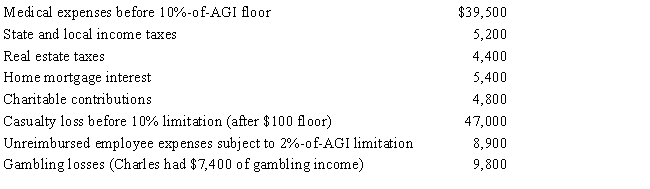

Charles, who is single and age 61, had AGI of $400,000 during 2017. He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Correct Answer:

Verified

Charles's itemized deductions ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Charles's itemized deductions ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q5: Grace's sole source of income is from

Q12: Dan contributed stock worth $16,000 to his

Q63: During the year, Victor spent $300 on

Q77: In Piatt County, the real property tax

Q78: George is single and age 56, has

Q79: Adrienne sustained serious facial injuries in a

Q84: On December 31, 2017, Lynette used her

Q87: Aaron, age 45, had AGI of $40,000

Q88: Georgia had AGI of $100,000 in 2017.

Q98: Fees for automobile inspections, automobile titles and