Multiple Choice

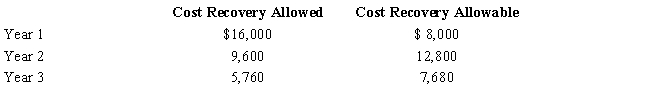

Tara purchased a machine for $40,000 to be used in her business. The cost recovery allowed and allowable for the three years the machine was used are computed as follows. If Tara sells the machine after three years for $15,000, how much gain should she recognize?

A) $3,480

B) $6,360

C) $9,240

D) $11,480

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q24: The "luxury auto" cost recovery limits change

Q27: Percentage depletion enables the taxpayer to recover

Q40: The basis of an asset on which

Q77: The key date for calculating cost recovery

Q84: Discuss the requirements in order for startup

Q88: On June 1, 2017, Norm leases a

Q90: On June 1, 2017, Irene places in

Q93: Discuss the criteria used to determine whether

Q94: James purchased a new business asset (three-year

Q95: Bhaskar purchased a new factory building and