Essay

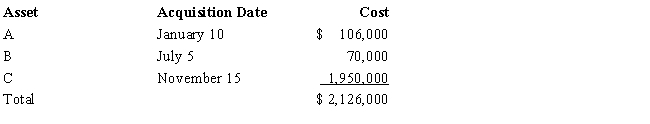

Audra acquires the following new five-year class property in 2017:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra claims the full available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Correct Answer:

Verified

As detailed below, the § 179 deduction i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: The maximum cost recovery method for all

Q36: The cost of a covenant not to

Q48: The only asset Bill purchased during 2017

Q49: Property which is classified as personalty may

Q51: Diane purchased a factory building on April

Q51: Motel buildings have a cost recovery period

Q53: Martin is a sole proprietor of a

Q54: On June 1, 2017, James places in

Q55: On June 1, 2017, Red Corporation purchased

Q56: Tom purchased and placed in service used