Essay

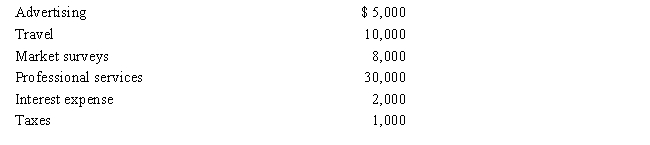

In 2017, Marci is considering starting a new business. Marci incurs the following costs associated with this venture.

Marci started the new business on January 5, 2018. Determine the deduction for Marci's startup costs for 2017.

Correct Answer:

Verified

Marci is not allowed to deduct...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: The § 179 limit for a sports

Q30: Cost depletion is determined by multiplying the

Q58: Hazel purchased a new business asset (five-year

Q59: On August 20, 2017, May placed in

Q64: Polly purchased a new hotel on July

Q65: On March 3, 2017, Sally purchased and

Q66: Orange Corporation begins business on April 2,

Q67: The amortization period for $58,000 of startup

Q68: Intangible drilling costs must be capitalized and

Q68: Carlos purchased an apartment building on November