Essay

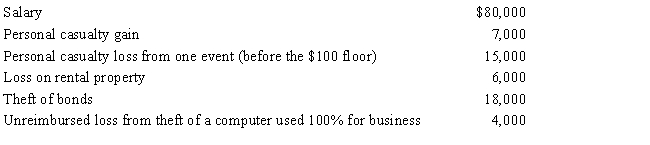

Gary, who is an employee of Red Corporation, has the following items for 2017:

Determine Gary's AGI and total amount of itemized deductions for 2017.

Determine Gary's AGI and total amount of itemized deductions for 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Five years ago, Tom loaned his son

Q49: Alma is in the business of dairy

Q59: In the current year, Juan's home was

Q60: Stella, age 38, is single with no

Q61: In 2017, Theo, an employee, had a

Q63: Steve and Holly have the following items

Q65: In 2017, Mary had the following items:

Q66: In 2017, Tan Corporation incurred the following

Q68: Why was the domestic production activities deduction

Q69: On September 3, 2016, Able, a single