Essay

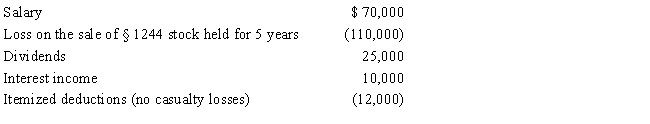

Jason, married and filing jointly, had the following income for 2017:

Jason has four dependent children. Calculate the net operating loss for 2017.

Jason has four dependent children. Calculate the net operating loss for 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: The amount of a loss on insured

Q14: A business bad debt is a debt

Q39: A cash basis taxpayer must include as

Q91: In 2017, Wally had the following insured

Q93: Which of the following events would produce

Q94: Roger, an individual, owns a proprietorship called

Q96: A nonbusiness bad debt can offset an

Q98: Green, Inc., manufactures and sells widgets. During

Q100: Taxpayer's home was destroyed by a storm

Q101: Jack, age 30 and married with no