Multiple Choice

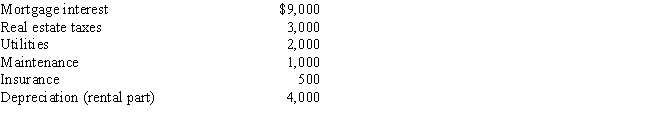

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year. The rental income is $6,000 and the expenses are as follows:  Using the IRS approach, total expenses that Robyn can deduct on her tax return associated with the beach house are:

Using the IRS approach, total expenses that Robyn can deduct on her tax return associated with the beach house are:

A) $0.

B) $6,000.

C) $8,000.

D) $12,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Isabella owns two business entities.She may be

Q12: If a taxpayer operated an illegal business

Q34: The period in which an accrual basis

Q44: If part of a shareholder/employee's salary is

Q48: Payments by a cash basis taxpayer of

Q49: Which of the following is not relevant

Q72: All domestic bribes (i.e., to a U.S.official)

Q94: If a taxpayer can satisfy the three-out-of-five

Q104: If a taxpayer operates an illegal business,

Q134: Which of the following legal expenses are