Multiple Choice

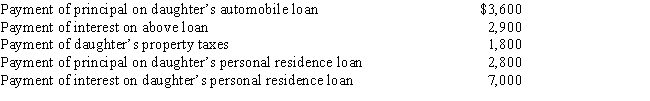

Melba incurred the following expenses for her dependent daughter during the current year:  How much may Melba deduct in computing her itemized deductions?

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Assuming an activity is deemed to be

Q30: Walter sells land with an adjusted basis

Q38: Two-thirds of treble damage payments under the

Q51: Alfred's Enterprises, an unincorporated entity, pays employee

Q79: An expense need not be recurring in

Q106: Can a trade or business expense be

Q107: How can an individual's consultation with a

Q108: Kitty runs a brothel (illegal under state

Q110: Tom operates an illegal drug-running operation and

Q139: Briefly discuss the disallowance of deductions for