Essay

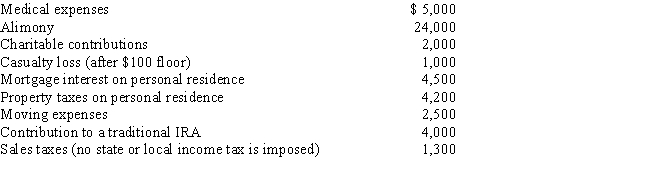

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Correct Answer:

Verified

Only the following e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Agnes operates a Christmas Shop in Atlantic

Q48: Deductions are allowed unless a specific provision

Q60: Trade or business expenses are classified as

Q77: Which of the following is a deduction

Q77: Beulah's personal residence has an adjusted basis

Q87: What losses are deductible by an individual

Q91: If a vacation home is classified as

Q93: Legal expenses incurred in connection with rental

Q105: The portion of a shareholder-employee's salary that

Q116: Martha rents part of her personal residence