Essay

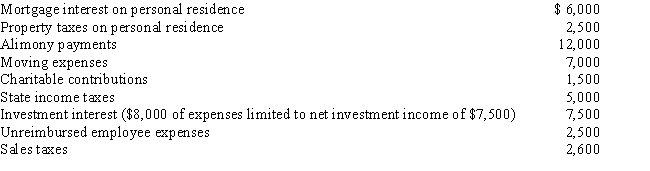

Arnold and Beth file a joint return. Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q11: Assuming an activity is deemed to be

Q12: During the year, Martin rented his vacation

Q38: Two-thirds of treble damage payments under the

Q53: The income of a sole proprietorship is

Q94: If a taxpayer can satisfy the three-out-of-five

Q117: Priscella pursued a hobby of making bedspreads

Q121: Max opened his dental practice (a sole

Q122: Mitch is in the 28% tax bracket.

Q139: Briefly discuss the disallowance of deductions for

Q143: Bruce owns several sole proprietorships. Must Bruce