Essay

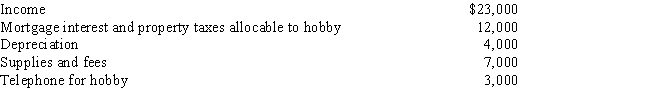

Calculate the net income includible in taxable income for the following hobby:

Correct Answer:

Verified

Otherwise deductible expenses must...

Otherwise deductible expenses must...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Otherwise deductible expenses must...

Otherwise deductible expenses must...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q6: Trade and business expenses should be treated

Q7: Expenses incurred for the production or collection

Q9: Benita incurred a business expense on December

Q13: For an activity classified as a hobby,

Q14: Al is single, age 60, and has

Q15: Which of the following may be deductible?<br>A)Bribes

Q16: Andrew, who operates a laundry business, incurred

Q60: None of the prepaid rent paid on

Q82: The Code does not specifically define what

Q85: If a vacation home is classified as