Multiple Choice

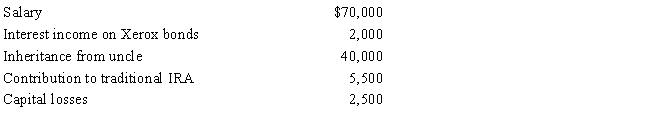

During 2017, Esther had the following transactions: Esther's AGI is:

A) $62,000.

B) $64,000.

C) $67,000.

D) $102,000.

E) $104,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q44: A child who is married cannot be

Q48: Jayden and Chloe Harper are husband and

Q49: Butch and Minerva are divorced in December

Q51: Darren, age 20 and not disabled, earns

Q52: Stealth taxes are directed at lower income

Q64: Matching <br>Regarding classification as a dependent, classify

Q74: In terms of the tax formula applicable

Q94: Matching <br>Regarding classification as a dependent, classify

Q95: Ellen, age 12, lives in the same

Q128: Once a child reaches age 19, the