Multiple Choice

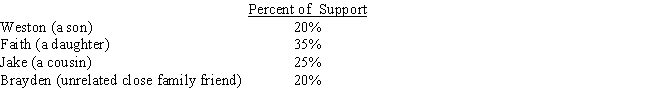

Millie, age 80, is supported during the current year as follows: During the year, Millie lives in an assisted living facility. Under a multiple support agreement, indicate which parties can qualify to claim Millie as a dependent.

A) Weston and Faith.

B) Faith.

C) Weston, Faith, Jake, and Brayden.

D) Faith, Jake, and Brayden.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following items, if any,

Q44: Adjusted gross income (AGI) appears at the

Q114: During 2017, Marvin had the following transactions:

Q115: Pedro is married to Consuela, who lives

Q117: Katrina, age 16, is claimed as a

Q121: During 2017, Trevor has the following capital

Q122: Tony, age 15, is claimed as a

Q123: In determining whether the gross income test

Q124: Which of the following taxpayers may file

Q127: Match the statements that relate to each