Multiple Choice

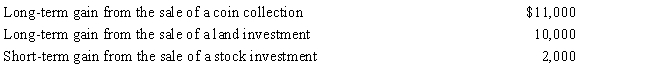

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2017: Kirby's tax consequences from these gains are as follows:

A) (5% × $10,000) + (15% × $13,000) .

B) (15% × $13,000) + (28% × $11,000) .

C) (0% × $10,000) + (15% × $13,000) .

D) (15% × $23,000) .

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Matching <br>Regarding classification as a dependent, classify

Q26: After her divorce, Hope continues to support

Q50: Many taxpayers who previously itemized will start

Q82: Katelyn is divorced and maintains a household

Q84: Roy and Linda were divorced in 2016.

Q85: For 2017, Tom has taxable income of

Q86: Which of the following characteristics correctly describes

Q89: Buddy and Hazel are ages 72 and

Q92: Monique is a resident of the U.S.

Q148: A taxpayer who itemizes must use Form