Multiple Choice

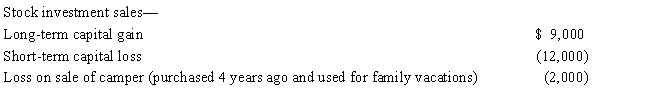

For the current year, David has wages of $80,000 and the following property transactions: What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: Match the statements that relate to each

Q47: An individual taxpayer uses a fiscal year

Q61: Match the statements that relate to each

Q71: Ellen, age 39 and single, furnishes more

Q72: Perry is in the 33% tax bracket.

Q74: Warren, age 17, is claimed as a

Q78: Nelda is married to Chad, who abandoned

Q79: In meeting the criteria of a qualifying

Q87: During the year, Kim sold the following

Q169: In which, if any, of the following