Essay

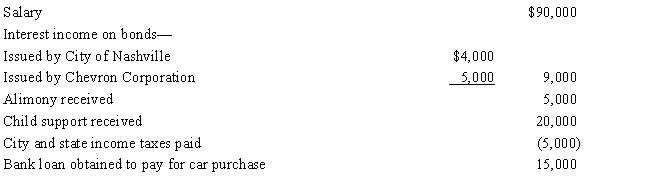

Emily had the following transactions during 2016:

What is Emily's AGI for 2017?

Correct Answer:

Verified

$100,000. $90,000 (salary) + $5,000 (int...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$100,000. $90,000 (salary) + $5,000 (int...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q8: A decrease in a taxpayer's AGI could

Q15: Gain on the sale of collectibles held

Q20: The basic and additional standard deductions both

Q22: Match the statements that relate to each

Q35: An increase in a taxpayer's AGI could

Q55: Deductions for AGI are often referred to

Q61: The Hutters filed a joint return for

Q69: Derek, age 46, is a surviving spouse.

Q70: During 2017, Madison had salary income of

Q81: As opposed to itemizing deductions from AGI,