Essay

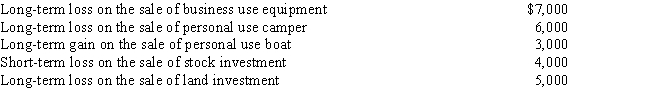

During the year, Irv had the following transactions:

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q19: Albert buys his mother a TV.For purposes

Q41: Regarding the rules applicable to filing of

Q49: Match the statements that relate to each

Q101: In resolving qualified child status for dependency

Q104: Evan and Eileen Carter are husband and

Q105: Maude's parents live in another state and

Q107: Heloise, age 74 and a widow, is

Q115: After paying down the mortgage on their

Q122: Adjusted gross income (AGI) sets the ceiling

Q127: Mel is not quite sure whether an