Essay

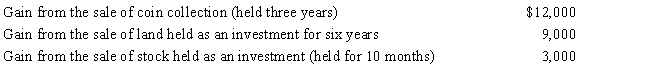

During 2017, Jackson had the following capital gains and losses:

a.How much is Jackson's tax liability if he is in the 15% tax bracket?

b.If his tax bracket is 33% (not 15%)?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: For dependents who have income, special filing

Q33: A qualifying child cannot include:<br>A)A nonresident alien.<br>B)A

Q79: Married taxpayers who file a joint return

Q102: Match the statements that relate to each

Q109: For tax purposes, married persons filing separate

Q138: Match the statements that relate to each

Q157: In order to claim a dependency exemption

Q164: During 2017, Sarah had the following transactions:

Q165: Edgar had the following transactions for 2017:<br>What

Q166: In early 2017, Ben sold a yacht,