Multiple Choice

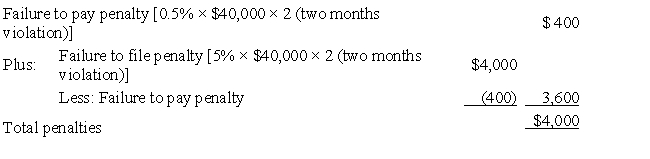

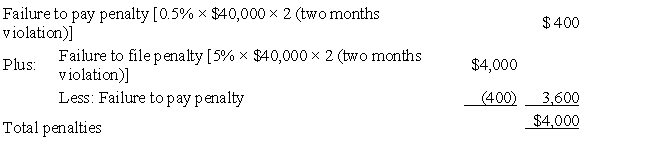

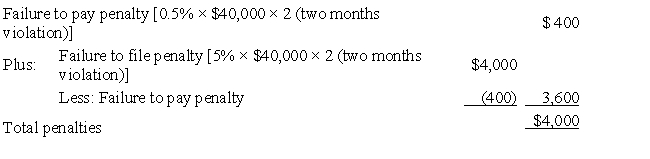

David files his tax return 45 days after the due date. Along with the return, David remits a check for $40,000 which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are:

A) $400.

B) $3,600.

C) $4,000.

D) $4,400.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The tax law allows, under certain conditions,

Q50: The tax law allows an income tax

Q68: Using the following choices, show the justification

Q72: Using the following choices, show the justification

Q75: Using the following choices, show the justification

Q91: States impose either a state income tax

Q100: Jason's business warehouse is destroyed by fire.

Q132: Match the statements that relate to each

Q148: Using the following choices, show the justification

Q149: For the negligence penalty to apply, the