Multiple Choice

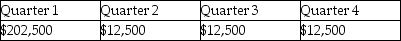

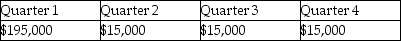

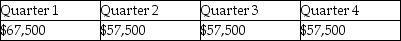

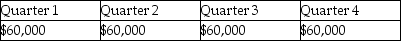

On January 5,2014,Eagle Corporation paid $50,000 in real estate taxes for the calendar year.In March of 2014,Eagle paid $180,000 for an annual machinery overhaul and $10,000 for the annual CPA audit fee.What amount was expensed for these items on Eagle's quarterly interim financial statements?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The following data relate to Falcon Corporation's

Q2: Sandpiper Corporation paid $120,000 for annual property

Q3: The accountant for Baxter Corporation has assigned

Q4: The following table is provided in the

Q6: Management-approach-based segments are called operating segments.

Q7: The following data relate to Elle Corporation's

Q8: Which of the following is not a

Q9: Leotronix Corporation estimates its income by calendar

Q10: How does GAAP view interim accounting periods?<br>A)As

Q11: For reporting purposes,a segment is considered material