Essay

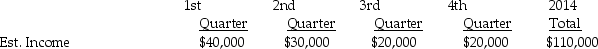

Maxtil Corporation estimates its income by calendar quarter as follows for 2014:

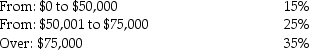

Income tax rates applicable to Maxtil:

Income tax rates applicable to Maxtil:

Required:

Required:

Determine Maxtil's estimated effective tax rate.

Correct Answer:

Verified

Income tax on estima...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Which one of the following operating segment

Q29: For an operating segment to be considered

Q30: Enterprises must report segment information using the

Q31: The estimated taxable income for Shebill Corporation

Q32: Pensions and corporate headquarters are all part

Q34: Rollins Publishing has five operating segments,as summarized

Q35: Enterprises must disclose the existence of major

Q36: An enterprise has eight reporting segments.Five segments

Q37: For internal decision-making purposes,Dashwood Corporation's operating segments

Q38: Which of the following conditions would not