Essay

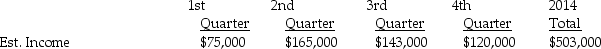

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2014,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Correct Answer:

Verified

Requirement 1

Calculation of e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Calculation of e...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Rollins Publishing has five operating segments,as summarized

Q35: Enterprises must disclose the existence of major

Q36: An enterprise has eight reporting segments.Five segments

Q37: For internal decision-making purposes,Dashwood Corporation's operating segments

Q38: Which of the following conditions would not

Q40: Similar operating segments may be combined if

Q41: Interim financial reports provide more timely,extensive information

Q42: For internal decision-making purposes,Calam Corporation's operating segments

Q43: The gross profit method for estimating inventory

Q44: Dott Corporation experienced a $100,000 extraordinary loss