Essay

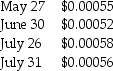

Tank Corporation,a U.S.manufacturer,has a June 30 fiscal year end.Tank sold goods to their customer in Columbia on May 27,2014 for 18,000,000 Columbian pesos.The customer agreed to pay pesos in 60 days.When the customer wired the funds to Tank on July 26,Tank held them in their bank account until July 31 before selling them and converting them to U.S.dollars.The following exchange rates apply:

Required:

Required:

Record the journal entries related to the dates listed above.If no entry is required,state "no entry."

Correct Answer:

Verified

Tank's Gen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Johnson Corporation (a U.S.company)began operations on

Q23: One reason corporations enter into a derivative

Q24: A U.S.importer that purchased merchandise from a

Q25: If a U.S.company is preparing a journal

Q26: On May 1,2014,Deerfield Corporation purchased merchandise from

Q28: Use the following information to answer the

Q29: Swaps are contracts to exchange an ongoing

Q30: The exchange rates between the Australian dollar

Q31: At the date the transaction is recognized,the

Q32: Piel Corporation (a U.S.company)began operations on January