Essay

On January 1,2014,Wrobel Company acquired a 90 percent interest in Sally Company for $270,000.On January 1,2014,Sally's total stockholders' equity was $300,000.The fair value and book value of Sally's individual assets and liabilities were equal.

On January 2,2014,Sally Company acquired a 10 percent interest in Wrobel Company for $70,000.On January 2,2014,Wrobel's total stockholders' equity was $700,000.The fair value and book value of Wrobel's individual assets and liabilities were equal.

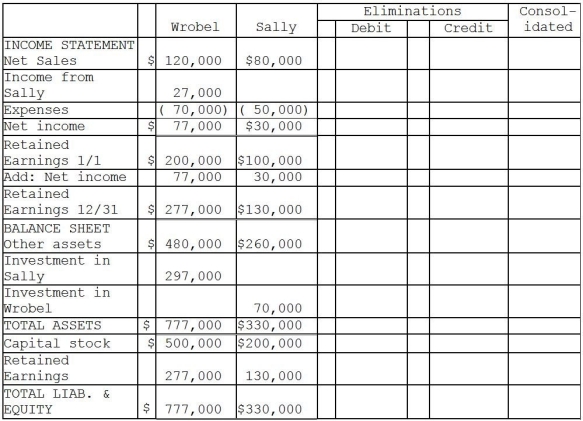

For the year ending December 31,2014,the following data is available:

The treasury stock method is used to account for the mutual stock holdings between Wrobel and Sally.The separate net incomes do not include investment income.

A partial working paper is available for the year ending December 31,2014.

Required:

Required:

Prepare the elimination entries for the year ending December 31,2014.

Do not enter them onto the worksheet.Instead,list them below.

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: The effect of mutually held parent stock

Q41: Parent stock that is held by the

Q42: On January 1,2014,Peabody Corporation acquired a

Q43: Use the following information to answer the

Q44: Indirect holdings are investments that enable the

Q45: Paglia Corporation owns 80% of Aburn Corporation

Q46: The conventional approach is appropriate for recording

Q48: Raymond Company owns 90% of Rachel Company.Rachel

Q49: Indirect holdings called connecting affiliates involves a

Q50: Padhy Corporation owns 80% of Abrams Corporation,Abrams