Essay

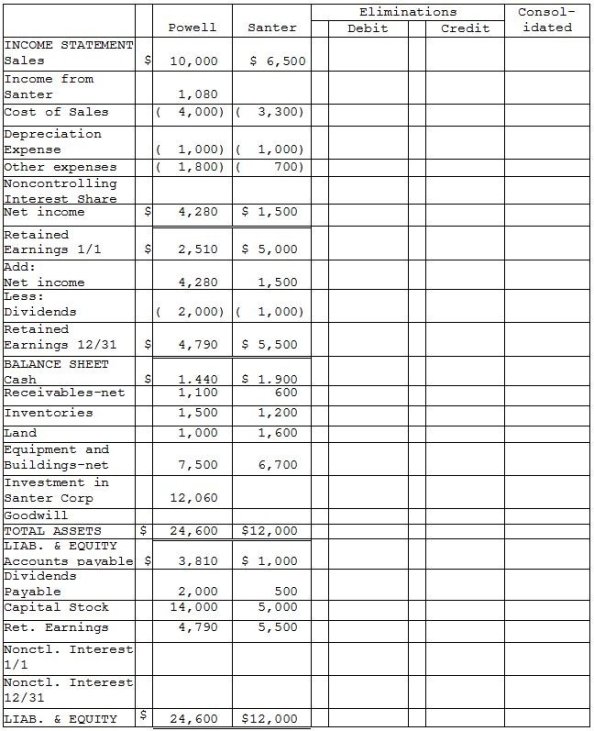

Powell Corporation acquired 90% of the voting stock of Santer Corporation on January 1,2014 for $11,700 when Santer had Capital Stock of $5,000 and Retained Earnings of $4,000.The amounts reported on the financial statements approximated fair value,with the exception of inventories,which were understated on the books by $500 and were sold in 2014,land which was undervalued by $1,000,and equipment with a remaining useful life of 5 years under the straight-line method which was undervalued by $1,500.Any remainder was assigned to goodwill.

Financial statements for Powell and Santer Corporations at the end of the fiscal year ended December 31,2015 appear in the first two columns of the partially completed consolidation working papers.Powell has accounted for its investment in Santer using the equity method of accounting.Powell Corporation owed Santer Corporation $100 on open account at the end of the year.Dividends receivable in the amount of $450 payable from Santer to Powell is included in Powell's net receivables.

Required:

Complete the consolidation working papers for Powell Corporation and Subsidiary for the year ended December 31,2015.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Flagship Company has the following information collected

Q37: Proceeds from the sale of land are

Q38: When preparing the consolidation workpaper for a

Q39: Platt Corporation paid $87,500 for a 70%

Q40: Adjustments made for consolidation statements impact both

Q42: A parent company uses the equity method

Q43: The portion of a subsidiary's net income

Q44: Which one of the following will increase

Q45: The consolidated cash flow statement is prepared

Q46: Pull Incorporated and Shove Company reported summarized