On December 31,2014,Patenne Incorporated Purchased 60% of Smolin Manufacturing for $300,000.The

Essay

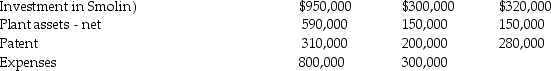

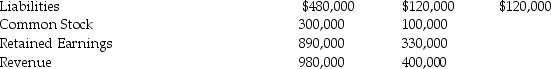

On December 31,2014,Patenne Incorporated purchased 60% of Smolin Manufacturing for $300,000.The book value and fair value of Smolin's assets and liabilities were equal with the exception of plant assets which were undervalued by $60,000 and had a remaining life of 10 years,and a patent which was undervalued by $40,000 and had a remaining life of 5 years.At December 31,2016,the companies showed the following balances on their respective adjusted trial balances:

Assets (includes

Assets (includes

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2016.

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2016.

Requirement 2: Calculate consolidated net income for 2016,and the amount allocated to the controlling and noncontrolling interests.

Requirement 3: Calculate the balance of the noncontrolling interest in Smolin to be reported on the consolidated balance sheet at December 31,2016.

Correct Answer:

Verified

Requirement 1:

Requirement 2:

Requirement 2:

Amort...

Amort...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Parakeet Company has the following information collected

Q18: A parent company uses the equity method

Q19: Pecan Incorporated acquired 80% of the voting

Q20: The trial balance approach to consolidation workpapers

Q21: Bird Corporation has several subsidiaries that are

Q23: On January 2,2014,Paleon Packaging purchased 90% of

Q24: Pawl Corporation acquired 90% of Snab Corporation

Q25: Use the following information to answer question(s)

Q26: On January 2,2014,PBL Enterprises purchased 90% of

Q27: A parent corporation owns 55% of the