Essay

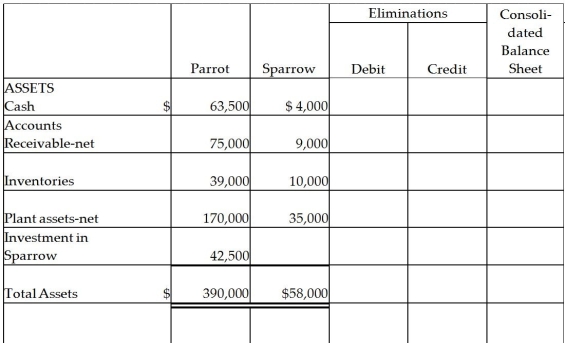

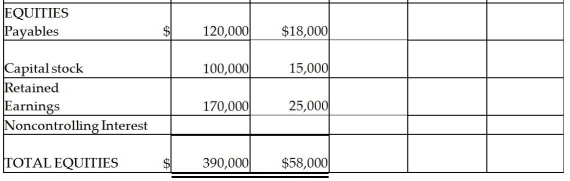

Parrot Inc.acquired an 85% interest in Sparrow Corporation on January 2,2014 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000.Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000.Balance sheets for Parrot and Sparrow on January 2,2014,immediately after the business combination,are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1,2014.

Correct Answer:

Verified

Preliminary computat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: On July 1,2014,Polliwog Incorporated paid cash for

Q39: Pomograte Corporation bought 75% of Sycamore Company's

Q40: A subsidiary can be excluded from consolidation

Q41: The acquisitions method for consolidation requires that

Q42: Passcode Incorporated acquired 90% of Safe Systems

Q44: The GAAP requires a noncontrolling interest in

Q45: Subsequent to an acquisition,the parent company and

Q46: When a parent acquires 100% of a

Q47: A consolidated income statement must clearly separate

Q48: On June 1,2014,Puell Company acquired 100% of