Essay

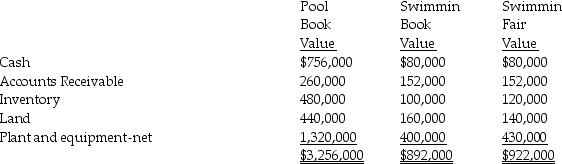

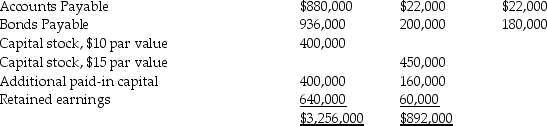

Pool Industries paid $540,000 to purchase 75% of the outstanding stock of Swimmin Corporation,on December 31,2014.Any excess fair value over the identified assets and liabilities is attributed to goodwill.The following year-end information was available just before the purchase:

Using the data provided above,assume that Pool decided rather than paying $540,000 cash,Pool issued 10,000 shares of their own stock to the owners of Swimmin.At the time of issue,the $10 par value stock had a market value of $60 per share.

Using the data provided above,assume that Pool decided rather than paying $540,000 cash,Pool issued 10,000 shares of their own stock to the owners of Swimmin.At the time of issue,the $10 par value stock had a market value of $60 per share.

Required: Prepare Pool's consolidated balance sheet on December 31,2014.

Correct Answer:

Verified

Requiremen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Pental Corporation bought 90% of Sedacor Company's

Q32: Pattalle Co.purchases Senday,Inc.on January 1 of the

Q33: On July 1,2014,Piper Corporation issued 23,000 shares

Q34: Park Corporation paid $180,000 for a 75%

Q35: The unamortized excess account is<br>A)a contra-equity account.<br>B)used

Q37: Percy Inc.acquired 80% of the outstanding stock

Q38: On July 1,2014,Polliwog Incorporated paid cash for

Q39: Pomograte Corporation bought 75% of Sycamore Company's

Q40: A subsidiary can be excluded from consolidation

Q41: The acquisitions method for consolidation requires that