Essay

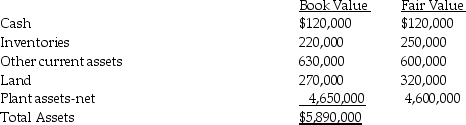

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31,2013.Parrot borrowed $2,000,000 to complete this transaction,in addition to the $640,000 cash that they paid directly.The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below.In addition,Sparrow had a patent that had a fair value of $50,000.

Required:

Required:

1.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow survives as a separate legal entity.

2.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow will dissolve as a separate legal entity.

Correct Answer:

Verified

1.General journal entry recorded by Parr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: It is frequently more expensive for a

Q36: Pepper Company paid $2,500,000 for the net

Q37: A business merger differs from a business

Q38: Firms should conduct an impairment test for

Q39: Which of the following methods does the

Q41: According to ASC 805-30,which one of the

Q42: The U.S.Department of Justice and the Federal

Q43: Pony acquired Spur Corporation's assets and liabilities

Q44: The GAAP defines the accounting concept of

Q45: Under the current GAAP,Goodwill arising from a