Essay

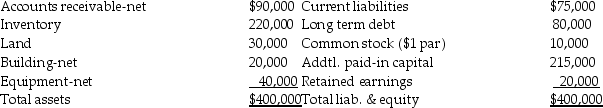

Bigga Corporation purchased the net assets of Petit,Inc.on January 2,2013 for $380,000 cash and also paid $15,000 in direct acquisition costs.Petit,Inc.was dissolved on the date of the acquisition.Petit's balance sheet on January 2,2013 was as follows:

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.

Required:

Prepare Bigga's general journal entry for the cash purchase of Petit's net assets.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Picasso Co.issued 5,000 shares of its $1

Q3: Samantha's Sporting Goods had net assets

Q4: For intangibles to be recognizable they must

Q5: A merger occurs when one corporation takes

Q6: On December 31,2013,Peris Company acquired Shanta Company's

Q7: In reference to the FASB disclosure requirements

Q8: When considering an acquisition,which of the following

Q9: Use the following information to answer

Q10: Historically,much of the controversy concerning accounting requirements

Q11: Durer Inc.acquired Sea Corporation in a business