Essay

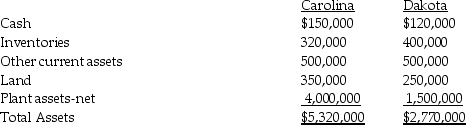

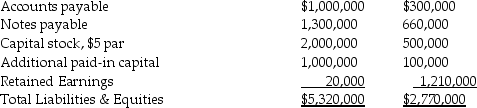

On January 2,2013 Carolina Clothing issued 100,000 new shares of its $5 par value common stock valued at $19 a share for all of Dakota Dressing Company's outstanding common shares in an acquisition.Carolina paid $15,000 for registering and issuing securities and $10,000 for other direct costs of the business combination.The fair value and book value of Dakota's identifiable assets and liabilities were the same.Assume Dakota Company is dissolved on the date of the acquisition.Summarized balance sheet information for both companies just before the acquisition on January 2,2013 is as follows:

Required:

Required:

Prepare a balance sheet for Carolina Clothing immediately after the business combination.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: In reference to the FASB disclosure requirements

Q8: When considering an acquisition,which of the following

Q9: Use the following information to answer

Q10: Historically,much of the controversy concerning accounting requirements

Q11: Durer Inc.acquired Sea Corporation in a business

Q13: According to ASC 810-10,liabilities assumed in an

Q14: The first step in recording an acquisition

Q15: On January 2,2013 Piron Corporation issued 100,000

Q16: In reference to international accounting for goodwill,U.S.companies

Q17: In a business combination,which of the following