Essay

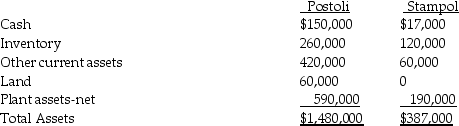

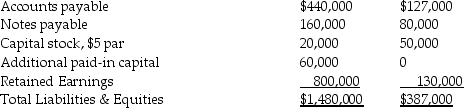

On June 30,2013,Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated.Postoli paid $40,000 in cash to the owner of Stampol,and signed a five-year note payable to the owners of Stampol in the amount of $200,000.Their closing balance sheets as of June 30,2013 are shown below.In the purchase agreement,both parties noted that Inventory was undervalued on the books by $10,000,and Pistoli would also take possession of a customer list with a fair value of $18,000.Pistoli paid all legal costs of the acquisition,which amounted to $7,000.

Required:

Required:

1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

Correct Answer:

Verified

Postoli's journal entry:

*Cash paymen...

*Cash paymen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: The first step in recording an acquisition

Q15: On January 2,2013 Piron Corporation issued 100,000

Q16: In reference to international accounting for goodwill,U.S.companies

Q17: In a business combination,which of the following

Q18: In August 1999,the Financial Accounting Standards Board

Q20: On January 2,2013 Palta Company issued 80,000

Q21: Under the acquisition method a combination is

Q22: Following the accounting concept of a business

Q23: Under the provisions of ASC 805-30,in a

Q24: On January 2,2013,Pilates Inc.paid $700,000 for