Essay

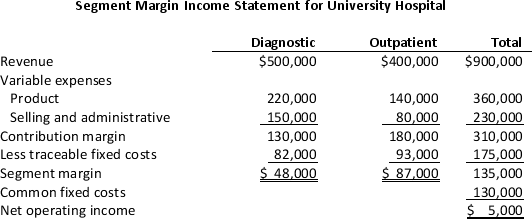

University Hospital provided the following income statement for two of its divisions: Diagnostic and Outpatient.Both divisions are structured as investment centers.

The average assets for Diagnostic and Outpatient divisions total $400,000 and $600,000,respectively.The required minimum rate of return for both divisions is 10%.

The average assets for Diagnostic and Outpatient divisions total $400,000 and $600,000,respectively.The required minimum rate of return for both divisions is 10%.

a.Calculate the current residual income for each division.

b.Why is residual income a better measure of performance for managers of investment centers than the overall profit compared to the flexible budget?

Correct Answer:

Verified

a. Residual income calculations:

Diagnos...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Diagnos...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Which of the following assets would not

Q38: If managers want to increase ROI,an increase

Q69: The price at which the exchange between

Q74: Which of the following is an advantage

Q78: A profit center manager should be evaluated

Q80: Common allocated fixed costs are an issue

Q81: In the calculation of ROI,the most common

Q86: Wrightsville Beach Company produces ice packs and

Q176: An investment center manager's performance is typically

Q182: The goal of setting a transfer price