Essay

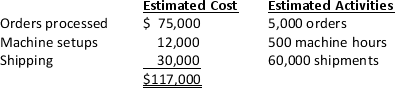

Jones Manufacturing Company makes two products.The company's budget includes $500,000 of overhead.In the past,the company allocated overhead based on estimated total direct labor hours of 20,000.Jones recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: processed purchase orders,machine setups,and good shipped.The following is a summary of company information:

Required:

a. Calculate the company’s overhead rate based on total direct hours.

b. Calculate the company’s overhead rates using the activity-based costing pools.

Correct Answer:

Verified

a. $500,000/20,000 = $25 per d...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: In the activity identification stage of implementing

Q20: The first step in implementing an activity-based

Q22: In implementing an activity-based costing system,once the

Q26: Those activities that create the product the

Q40: Which of the following is the step

Q43: Identifying the activities performed in the organization

Q88: Austin Company manufactures 2 products,Flacca and Gordo.Overhead

Q93: Under activity-based costing,selling and administrative costs should

Q171: Assume you have been hired by a

Q175: Identifying activities performed in the organization is