Essay

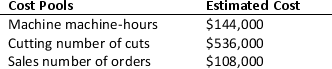

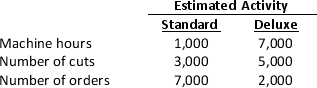

Camilla,Inc.uses activity-based costing to cost its two products: Standard and Deluxe.The company has provided the following data relating to its activities:

a.What is the activity rate for the sales cost pool?

b.If actual activity is the same as that estimated,what is the total amount of overhead cost allocated to the Deluxe product?

Correct Answer:

Verified

a.$108,000/9,000 = $12 per order

b.Machi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.Machi...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Although the total amount of allocated overhead

Q9: First-stage allocation is the process of assigning

Q13: Which of the following would be considered

Q45: Megan Industries manufactures several products including a

Q47: Since a batch-level activity is based on

Q48: Brandon Consulting Company is headquartered in Atlanta

Q49: In an activity-based costing system,which of

Q52: Gooding Company manufactures two models of its

Q55: A&W Manufacturing uses an activity-based costing system

Q156: Which of the following activities would be