Multiple Choice

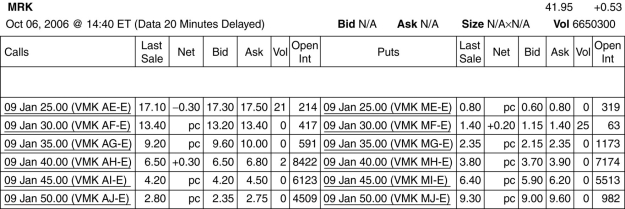

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-How many of the January 2009 call options are in-the-money?

A) 1

B) 2

C) 3

D) 4

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Which of the following statements is FALSE?<br>A)Options

Q9: Luther Industries is currently trading for $27

Q20: According to put-call parity, which of the

Q21: When is an option in-the-money?

Q22: A share of stock can be thought

Q25: The _ side of an options contract

Q26: Suppose that a stock sells at a

Q27: The Black-Scholes formula gives the price of

Q28: Options are also called derivative assets because

Q34: Which of the following statements is FALSE?<br>A)A