Multiple Choice

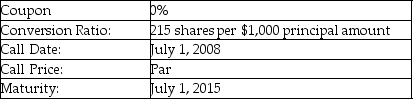

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $4.70. If the bonds are called on this date, which of the following is the action most likely to be taken by a holder of bond of face value of $10,000?

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $4.70. If the bonds are called on this date, which of the following is the action most likely to be taken by a holder of bond of face value of $10,000?

A) Convert the bond and accept shares with a value of $10,000.

B) Convert the bond and accept shares with a value of $9599.75.

C) Convert the bond and accept shares with a value of $10,105.00.

D) Accept the call price and receive $10,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: A company issues a callable (at par)

Q21: Supreme Industries issues the following announcement to

Q22: A company issues a callable (at par)

Q23: Covenants in a bond contract restrict the

Q24: In which of the following situations would

Q26: What is yield to worst?

Q27: Eurobonds issued in the United Kingdom could

Q28: A firm issues $300 million in straight

Q29: Which of the following is an advantage

Q30: A convertible bond has a face value