Multiple Choice

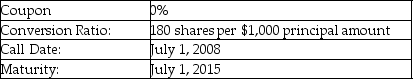

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $6.00. What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $6.00. What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A) par

B) par plus 12%

C) par plus 8%

D) par plus 1.2%

Correct Answer:

Verified

Correct Answer:

Verified

Q52: If a company issues both a straight

Q53: Foreign bonds in the United States are

Q54: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" A firm issues

Q55: A company issues a 10-year, callable bond

Q56: Which of the following statements is FALSE?<br>A)

Q58: What kind of corporate debt has a

Q59: A firm issues $500 million in straight

Q60: Which of the following is NOT an

Q61: What is a call provision?<br>A) the periodic

Q62: Athelstone Realty issues debt with a maturity