Multiple Choice

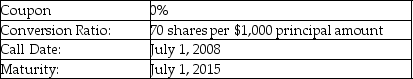

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $15.14. What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A firm issues the convertible debt shown above. The price of stock in this company on July 1, 2008 is $15.14. What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A) par plus 3.29%

B) par plus 3.89%

C) par plus 4.49%

D) par plus 5.98%

Correct Answer:

Verified

Correct Answer:

Verified

Q14: A firm issues $225 million in straight

Q17: A company issues a callable (at par)

Q18: Which of the following statements is FALSE?<br>A)

Q20: A company issues a callable (at par)

Q21: Supreme Industries issues the following announcement to

Q22: A company issues a callable (at par)

Q23: Which of the following statements is FALSE?<br>A)A

Q23: Covenants in a bond contract restrict the

Q24: In which of the following situations would

Q37: Which of the following statements is FALSE