Multiple Choice

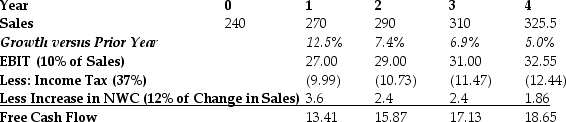

Use the table for the question(s) below. FCF Forecast ($ million)  Banco Industries expect sales to grow at a rapid rate over the next 3 years, but settle to an industry growth rate of 5% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. Banco industries has a weighted average cost of capital of 11%, $40 million in cash, $70 million in debt, and 18 million shares outstanding. If Banco Industries can reduce its operating expenses so that EBIT becomes 12% of sales, by how much will its stock price increase?

Banco Industries expect sales to grow at a rapid rate over the next 3 years, but settle to an industry growth rate of 5% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. Banco industries has a weighted average cost of capital of 11%, $40 million in cash, $70 million in debt, and 18 million shares outstanding. If Banco Industries can reduce its operating expenses so that EBIT becomes 12% of sales, by how much will its stock price increase?

A) $3.27

B) $3.92

C) $5.72

D) $9.80

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Gonzales Corporation generated free cash flow of

Q24: Which is the best valuation technique when

Q25: Individual investors trade conservatively, given the difficulty

Q26: Advanced Chemical Industries is awaiting the verdict

Q27: Which of the following statements is FALSE?<br>A)

Q29: Which of the following statements is FALSE?<br>A)

Q30: Individual investors' tendency to trade too much

Q31: Use the table for the question(s) below.

Q32: Use the figure for the question(s) below:

Q33: Which of the following statements is FALSE?<br>A)